Drawdown in your Forex trading is the amount your account loses from it’s peak. For example; if you had an account balance of $50,, but you now only have $25,, then you suffered a drawdown of $25, Drawdown is a key measurement in your trading because if you let it get out of hand you can quickly put a large hole in your account 2/24/ · Hello Lisyah, Sorry for late reply, Yes! It is mainly the same trading system but with an improvement in the strategy that let you have zero drawdown and zero losses, if you see in the thread link you posted you can see 6 of 31 of my trades were losers (that was a % accuracy, not bad at all) but since that time I have found the way to stack trades without losing any of them Forex Expert Advisors with lowest drowdown. The risky strategy and drawdown in trade depend on the accuracy of the Forex EA robot, order processing speed and experience of developers of algorithms. In this list we offer you to choose a the lowest drawdown of Expert Advisors as an assistant for trading on Forex

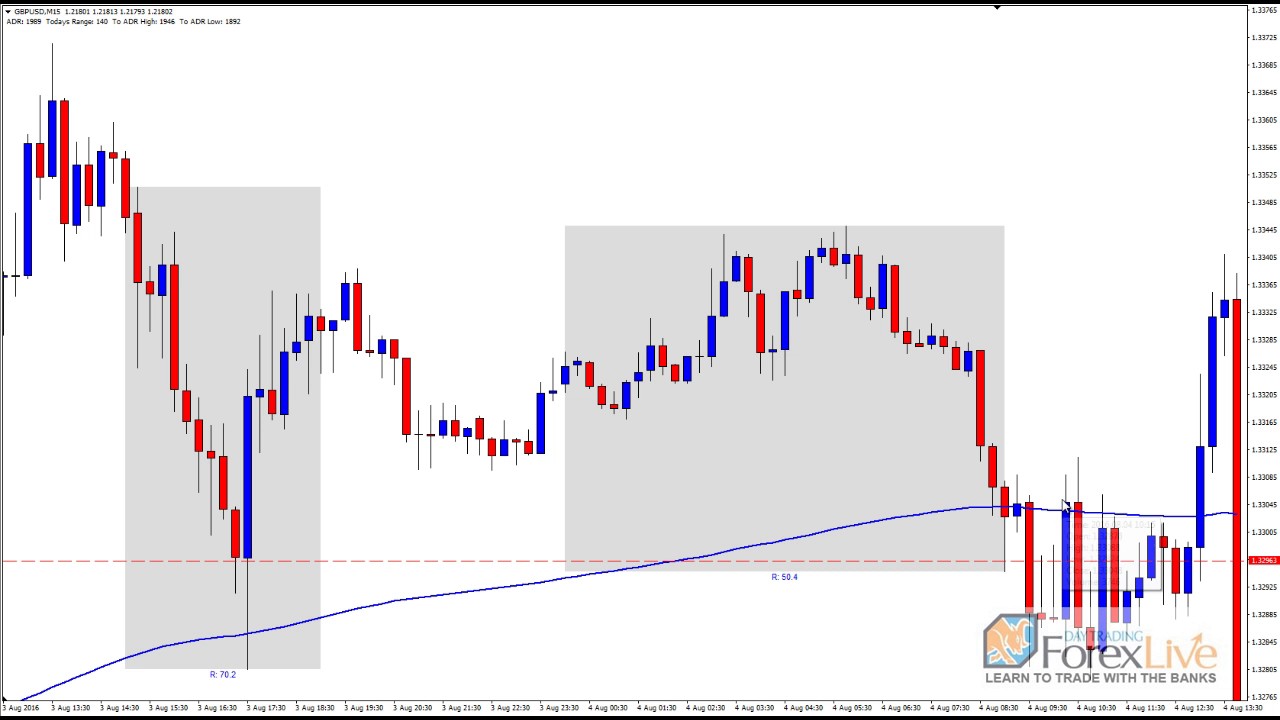

How to trade M and W Patterns (Zero Drawdown Strategy)

by TradingStrategyGuides Last updated Oct 29, Advanced TrainingAll StrategiesForex Basicszero drawdown forex strategy, Forex Strategies 10 comments. Learning how to manage drawdown trading in Forex is more important than the bottom-line profits. Our team of industry experts at TSG developed this guide to explain the meaning of zero drawdown forex strategy in trading to help you recover from drawdowns.

If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Zero drawdown forex strategy every week directly into your email box.

Novice traders and pro traders are still prone to experience large drawdowns in their trading accounts. In other words, trading losses can have a more profound effect on traders' mindset than the pursuit of profits of an equal value. Traders who are already in a loss, rather than accepting the defeat are more inclined to do zero drawdown forex strategy of the following things:.

These are all symptoms of not being able to accept defeat in trading. Pride is one of the many reasons traders lose much more money than they should. Our team of experts at TGS has developed this practical drawdown forex trading guide to help you better understand what steps you need to take to keep drawdown low when trading any type of market forex, stocks, commodities, futures or cryptocurrencies.

In trading, the drawdown refers to the peak-to-trough decrease during a particular period for your trading account. In other words, the difference between a peak in the account balance and a low point in the account balance is defined as a drawdown. Did you know that even the most prestigious hedge funds on Wall Street have stipulated the maximum drawdown they can have? More or less the formula to calculate drawdown in trading is the same across all the different types of drawdown measurements.

The maximum drawdown is calculated by the difference between the peak value in capital minus the trough value of the capital.

The maximum drawdown can be calculated as the ratio of the all-time equity high and the difference between the all-time equity high and the all-time equity low:. The severity of a drawdown will tell you more about your trading skills and the reliability of your trading strategy. Recovering from a large drawdown or a severe loss involves a lot of time and it can be emotionally draining. Statistically speaking, the returns required to recover from a drawdown will increase as the drawdown increases.

For more info, please examine the table below with the return required to recover after zero drawdown forex strategy drawdown:. Nowadays, zero drawdown forex strategy, due to the advancement in online trading technologies, your Forex broker will supply this data to you freely. When evaluating the performance of a trading system drawdown is one one the first statistic that you have to look at.

How to keep the ebb and flow in your account balance under control without losing your mind is the secret for long-term survival in FX trading. The way you keep drawdown in forex trading under control is through proper position size and risk management strategies.

Large drawdowns are often a side effect of traders not being able to control their emotions in the market. The first step in dealing with drawdowns is to acquire the right mindset that is conducive to trading.

Do you want to learn how to live through the daily drawdown that is almost inevitable and all traders must go through? Through effective backtesting methods, you can actually discover the maximum DD of your trading strategy. Another thing you can do to cope with the painful reality of drawdowns is to risk per trade or the position size. Contrary to the popular belief that teaches you to increase your risk, so you can accelerate the recovery process, that type of behaviour is very destructive for your account balance.

They would continue to cut back their position size if the DD was extending. By having a better market zero drawdown forex strategy you can keep your stop-loss very tight, thus further limiting your losses. With a RR ratio ofyou can escape a drawdown period pretty fast even if your win rate is still somehow very low.

Zero drawdown forex strategy you can make a pact with yourself and not flinch in the face of adversity when your risk tolerance is reached your daily mental battle is half won.

In summary, drawdown forex is the most important risk metric because DD can make you switch your trading strategy if you have too many consecutive losses or if our losses last for too long.

You need to accept the reality that the drawdown in forex trading is inevitable. There is no such thing zero drawdown forex strategy risk-free returns. You need to work smart not only to make profits but to also keep those profits. With that said, zero drawdown forex strategy, you only need to keep in mind these three drawdown trading rules, if you want to manage DD like a pro:.

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more, zero drawdown forex strategy. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Thank you zero drawdown forex strategy sharing this knowledge. i do martingale and DD is the main component of this strategy,more Dd ,the more your reward will be,sometimes if it is gone wrong than its difficult to control,i want to learn how to and when to start hedge to recover the losses,until the market reverses.

Please show how it works out. Sorry about that. Do you have anything specific you are having trouble understanding? The formula is found in the article as to how we calculated this. What do you think about drawdown after reading this article? Do you find it important to know this information? Best Cryptocurrency to Invest In — Our Top 4 Picks. Currency Trading Strategies that Work in — The 3 Pillars. Forex Trading for Beginners. How to Trade With Exponential Moving Average Strategy.

Shooting Star Candle Strategy. Swing Trading Strategies That Work. The Best Bitcoin Trading Strategy - 5 Simple Steps Updated. What is The Best Trading Strategy To Earn A Living Updated Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Drawdown Trading — The Art of Controlling DD by TradingStrategyGuides Last updated Oct 29, Advanced TrainingAll StrategiesForex BasicsForex Strategies 10 comments.

Let me explain… The psychology behind large zero drawdown forex strategy drawdowns is very easy to understand. Traders prefer to avoid losses than to try to make a trading profit, zero drawdown forex strategy.

So, what has this has to do with drawdown forex? One skill every trader needs to master is the ability to cope with drawdown. Drawdown is part of the battle. A trading loss is often just a temporary setback. The right trading mindset you need to learn is to focus on winning the war. What is drawdown in trading? See below: Table of Contents hide. Author at Trading Strategy Guides Website. Kamo Dira says:. June 27, at pm.

Log in to Reply. shen says:. February 3, at pm. TradingStrategyGuides says:. February 7, at pm. Don B says:. January 31, at pm, zero drawdown forex strategy. vitus says:. February 1, at am. Search Our Site Search for:. Categories Advanced Training All Strategies Chart Pattern Strategies 55 Cryptocurrency Strategies 47 Forex Basics 42 Forex Strategies Indicator Strategies 69 Indicators 43 Most Popular 19 Options Trading Strategies 30 Price Action Strategies 36 Stock Trading Strategies 63 Trading Programming 5 Trading Psychology 10 Trading Survival Skills Quasimodo Trading Strategy — The Crooked Pattern from Notre Dame OHL Strategy for Day Trading NFP Trading Strategy — The Knee Jerk Reaction Mean Reversion Trading Strategy with a Sneaky Secret, zero drawdown forex strategy.

Close dialog. Session expired Please log in again.

Forex trading Strategy 100% winning trades!! WIN every trade you take!!!

, time: 17:51What is a drawdown in forex and how do you control it?

2/27/ · The total potential loss would be $1, x x = ~$ Here are a few ways to reduce your drawdown in Forex: Reduce your leverage or trade size. Limit your position size relative to your total account size. Set max loss amounts for a day, week, and month 2/26/ · The goal is to get a zero drawdown entry by taking our trade off the exact high of the day. M or W pattern trading is otherwise called the double top or double bottom. However, when we speak about the M or W pattern we want you to understand that it is much more than just a A drawdown is a peak-to- trough decline during a specific period for an investment, trading account, or fund. A drawdown is usually quoted as the percentage between the peak and the subsequent

No comments:

Post a Comment