Feb 01, · Sometimes the price goes up or down very strongly and suddenly and then turns around, and so it forms a spike on the price chart. This phenomenon can 99% be seen on the Forex market because it is a too volatile market, and the price starts moving strongly very fast and then it changes it direction. These strong movements form because of the sudden huge transactions that are triggered Feb 09, · #1 News Spikes Will Make You Money (on average) It’s simple maths. Imagine each unexpected spike caused by news is a coin flip. Heads is a bullish spike and tails a bearish spike. That gives each news based spike a 50/50 chance of pushing price in your direction. Now let’s add in another factor: risk to reward ratio As a news trader, you are trying to achieve two things: Take advantage of the short-term spike in volatility While keeping your transaction costs as low as possible; Because news can bring increased volatility in the forex market (and more trading opportunities), it is important that we trade currencies that are deeply blogger.comted Reading Time: 4 mins

Why You Should Ignore News in Forex • Forex4noobs

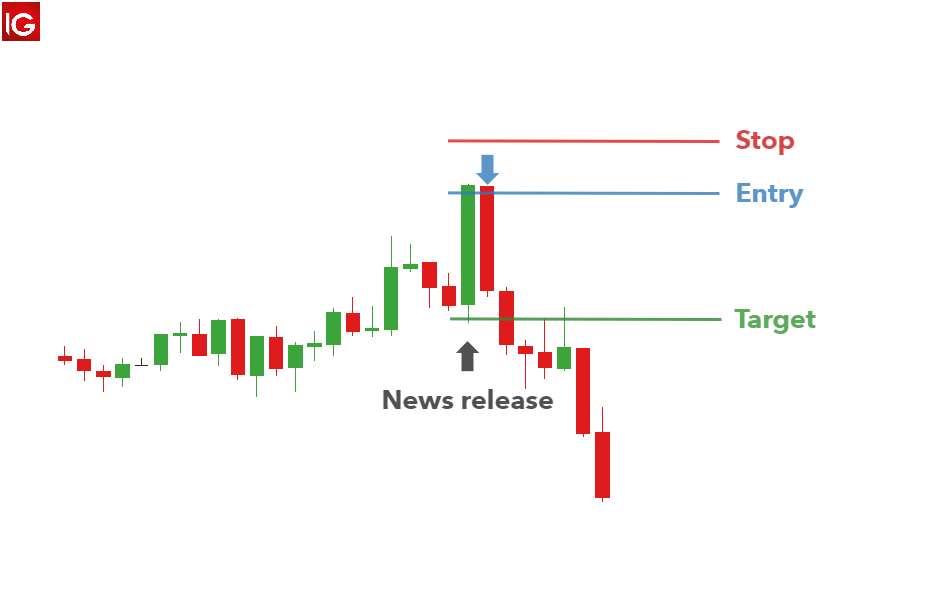

The sudden large movement on the Forex market due to an imbalance of liquidity is news that usually cause spike in forex price a spike. We can see such spikes most of the time on major data releases such as Non-Farm Payroll NFPFOMC statement, ECB Press conference, Rate declaration, etc.

We can also see such a spike in normal market conditions without news. To understand this topic first you need to know about Liquidity. Below we write details of liquidity activities and how it influences the forex chart to make a spike.

Liquidity is a measure of how easily an asset can be exchanged. Liquidity is an economic term that designates the amount of money immediately available. Thus, when we talk about liquidity, we tend to designate the assets, in cash. Market liquidity depends on the asset concerned, but within the same asset class, there are also different levels of liquidity.

Infect, for the liquidity forex market moves in a certain direction. Liquidity risk is an inherent risk in investing. It refers to the fact of not being able to sell its assets m at a price far below their intrinsic value.

This fall in prices in order to conclude a sale on an illiquid market is called an illiquidity discount. Liquidity is very much relative to create a spike in the forex chart. Forex Spike Trading is a popular trading style to some traders, news that usually cause spike in forex price, I am here going to describe the financial, technical causes behind the creating spikes on the chart.

To build up Spike Trading Strategy you need to know the real cause of Spike. As a trader, you already familiar with also 2 types of spikes we can see in the market: a. False spike b. Real spike. I have stated here those types to make it easy to understand the topics. Excessive liquidity and illiquidity in banking are situations of concern for the monetary authorities of a country.

Excessive liquidity leads to a Real spike in the market, news that usually cause spike in forex price. When there is excessive liquidity market spikes and make a fresh movement. The market needs not any news or fundamental issue for this movement. Most of you may be surprised by seeing this movement news that usually cause spike in forex price any news. But the truth is that when there is excessive liquidity market moves crazily and this leads to a fresh movement.

This excessive liquidity play in the market because of Professional money, Big investor, or Bank takes their position. This movement can occur at any time with or without any news.

Lack of liquidity leads to a False spike in the market. Illiquidity raises fears of bank panics, which can lead to rushes on deposits, sometimes leading to banking crises. In forex trading, we refer to the market liquidity is closely linked to that of the liquidity of a financial asset. This refers to the speed with which this asset can be exchanged for money without loss of value.

Illiquidity occurs mostly at the time of the news. This is because if there is a lack of liquidity market moves crazily up or down to collect the liquidity. This is because when markets make such a false spike to collect liquidity the interbank cannot shift the exchange rate and they still trade with the previous price level, for this reason, the market return to the previous price by creating a false spike.

PreferForex traded all cautiously all the market situation upon best analysis and market information that us unique forex signals provider.

The Reason of Spike in Forex Chart. What is the spike in the forex chart? What is Liquidity? Liquidity risk: one of the main risks linked to investment Liquidity risk is an inherent risk in investing.

In this view mainly two reasons are behind here: 1. Excessive liquidity 2. Lack of liquidity. Excessive Liquidity Excessive liquidity and illiquidity in banking are situations of concern for the monetary authorities of a country. Lack of Liquidity Lack of liquidity leads to a False spike in the market. See The Full Benefits, news that usually cause spike in forex price.

�� GOLD LIVE MARKET PRICE - XAUUSD TIMEFRAMES M5-M15-H1 TREND \u0026 POWER INDICATORS

, time: 8:18Natural gas prices hit a two-year high at a time of year when prices usually don't spike

Forex Spike Trading is a popular trading style to some traders, I am here going to describe the financial, technical causes behind the creating spikes on the chart. To build up Spike Trading Strategy you need to know the real cause of Spike. In this view mainly two reasons are behind here: 1. Excessive blogger.comted Reading Time: 3 mins Feb 22, · Forex is really not that volatile compared to other major asset classes like stocks and commodities. But still markets are generally unencumbered in the major pairs and therefore spikes in volatility can happen. Take what happened with the Swiss Franc a few years ago for example, or GBPUSD recently with news of Brexit Nov 19, · #1 News Spikes Will Make You Money (on average) It’s simple maths. Imagine each unexpected spike caused by news is a coin flip. Heads is a bullish spike and tails a bearish spike. That gives each news based spike a 50/50 chance of pushing price in your direction. Now let’s add in another factor: risk to reward blogger.coms: 7

No comments:

Post a Comment