5/11/ · The Money Flow Index (MFI) is a trading tool that incorporates volume and price data. It can be used to generate trade signals based on overbought and oversold levels as well as divergences 7/9/ · MFI Forex Indicator – Conclusions. As we have seen, the MFI indicator is a useful tool for gauging buying and selling pressure caused by the flow of money into and out of a particular market. A simple use of the indicator is to identify potential reversals at the times when oversold or overbought values are blogger.comted Reading Time: 8 mins Market Facilitation Index (MFI) "The MFI is a measure of the market's willingness to move the price. I cannot overemphasize the value of this indicator. It is a more truthful measure of market action than any stochastic, RSI (Relative Strength Index) or other momentum indicator." Bill Williams

Track the Pulse of the Market with the Money Flow Index Indicator - Admirals

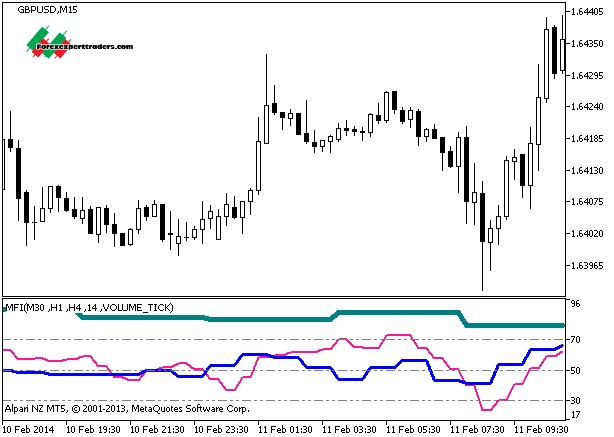

The Money Flow Index MFI is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset. It can also be used to spot divergences which warn of a trend change in price. The oscillator moves between 0 and Unlike conventional oscillators such as the Relative Strength Index RSImfi indicator in forex, the Money Flow Index incorporates both price and volume data, as opposed to just price.

For this reason, some analysts call MFI the volume-weighted RSI. When the price advances from one period to the next Raw Money Flow is positive and it is added to Positive Money Flow. When Raw Money Flow is negative because the price dropped that period, it is added to Negative Money Flow. There are several steps for calculating the Money Flow Index.

If doing it by hand, using a spreadsheet is recommended. One of the primary ways to use the Money Flow Index is when there is a divergence. A divergence is when the oscillator is moving in the opposite direction of price. This is a signal of a potential reversal in the prevailing price trend. For example, a very high Money Flow Index that begins to fall below a reading of 80 while the underlying security continues to climb is a price reversal signal to the downside.

Conversely, mfi indicator in forex, a very low MFI reading that climbs above a reading of 20 while the underlying security continues to sell off is a price reversal signal to the upside. Traders also watch for larger mfi indicator in forex using multiple waves in the price and MFI. This could foreshadow a decline in price. The overbought and oversold levels are also used to signal possible trading opportunities.

Moves below 10 and above 90 are rare. Traders watch for the MFI to move back above 10 to signal a long trade, and to drop below 90 to signal a short trade. Other moves out of overbought or oversold territory can also be useful. For example, mfi indicator in forex, when an asset is in an uptrenda drop below 20 or even 30 and then a rally back above it could indicate a pullback is over and the price uptrend is resuming.

The same goes for a downtrend, mfi indicator in forex. A short-term rally could push the MFI up to 70 or 80, but when it drops back below that could be the time to enter a short trade in preparation for another drop.

The MFI and RSI are very closely related. The main difference is that Mfi indicator in forex incorporates volume, while the RSI does not. Proponents of volume analysis believe it is a leading indicator.

Therefore, they also believe that MFI will provide signals, and warn of possible reversals, in a more timely fashion than the RSI. One indicator is not better than the other, they are simply incorporating different elements and will, therefore, provide signals at different times.

The MFI is capable of producing false signals. This is when the indicator does something that indicates a good trading opportunity is present, but then the price doesn't move as expected resulting in a losing trade. A divergence may not result in a price reversal, for instance, mfi indicator in forex. The indicator may also fail to warn of something important.

For example, while a divergence may result in a price reversing some of the time, divergence won't be present for all price reversals. Because of this, it is recommended that traders use other forms of analysis and risk control and not rely exclusively on one indicator. Advanced Technical Analysis Concepts. Technical Analysis Basic Education.

Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Key Technical Analysis Concepts. Getting Started with Technical Analysis. Essential Technical Analysis Strategies. Technical Analysis Patterns. Technical Analysis Indicators. Technical Analysis Technical Analysis Basic Education.

What Is the Money Flow Index MFI? Key Takeaways The Money Flow Index MFI is a technical indicator that generates overbought or oversold signals using both prices and volume data. An MFI reading above 80 is considered overbought mfi indicator in forex an MFI reading below 20 is considered oversold, although levels of 90 and 10 are also used as thresholds.

A divergence between the indicator and price is noteworthy. For example, if the indicator is rising while the price is falling or flat, mfi indicator in forex, the price could start rising. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms Money Flow Money flow is calculated by averaging the high, low and closing prices, and multiplying by the daily volume. Commodity Channel Index CCI Definition and Uses The Commodity Channel Index Mfi indicator in forex is a technical indicator that measures the difference between the current price and the historical average price.

Relative Strength Index RSI The Relative Strength Index RSI is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or mfi indicator in forex conditions. Intraday Momentum Index IMI Definition The Intraday Momentum Index IMIis a technical indicator that combines candlestick analysis with the relative strength index to provide insights. What Is the Force Index Definition and Its Uses? The force index is a technical indicator that uses price and volume to determine the power behind a price move.

The force index can also identify potential turning points in price. Stochastic RSI - StochRSI Definition The Stochastic RSI, or StochRSI, mfi indicator in forex, is a technical analysis indicator created by applying the Stochastic oscillator formula to a set of relative strength index RSI values.

Its primary function is to identify overbought and oversold conditions. Partner Links. Related Articles. Technical Analysis Basic Education How the Money Flow Index and Relative Strength Index Differ. Technical Analysis Basic Education The Difference Between Chaikin Money Flow CMF and Money Flow Index MFI?

Technical Analysis Basic Education Money Flow: The Basics. Advanced Technical Analysis Concepts Kairi Relative Index: The Forgotten Oscillator.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Profitable trading strategies using Money Flow Index (MFI)

, time: 4:47What Is The MFI Indicator And How Do You Use It? - Admirals

7/9/ · MFI Forex Indicator – Conclusions. As we have seen, the MFI indicator is a useful tool for gauging buying and selling pressure caused by the flow of money into and out of a particular market. A simple use of the indicator is to identify potential reversals at the times when oversold or overbought values are blogger.comted Reading Time: 8 mins Market Facilitation Index (MFI) "The MFI is a measure of the market's willingness to move the price. I cannot overemphasize the value of this indicator. It is a more truthful measure of market action than any stochastic, RSI (Relative Strength Index) or other momentum indicator." Bill Williams 5/11/ · The Money Flow Index (MFI) is a trading tool that incorporates volume and price data. It can be used to generate trade signals based on overbought and oversold levels as well as divergences

No comments:

Post a Comment