May 07, · Forex commissions are fees assessed by forex brokers. While sometimes the word “commissions” and the word “spread” are used interchangeably, as you will see, they are not always one and the same. Commissions can be assessed as pure spread. But they can also be assessed in addition to blogger.comted Reading Time: 9 mins Jan 22, · The forex broker is earning money by an additional trading commission fee which you are paying each trade. BDSwiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset Nov 03, · Trading forex offers an exclusive advantage over other types of trading: reduced fees and commissions. This is due to the fact that most fx brokers charge a variable commission on the spread rather than charging fixed or percentage fees on the value of the trade. They can also charge a fixed commission per trade, though this is less blogger.comted Reading Time: 5 mins

# 10 Forex Brokers with ZERO (no) Spreads | Comparison

Do you want to pay fewer trading fees when investing in currency pairs? On this page, we will show you the top 10 companies which are offering trading with starting pips at 0. Trading fees can be very expensive when you are doing scalping or high-volume trading. By choosing one of our recommended Forex Brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading. Overall, we tested more than 50 Forex Brokers in 9 years of trading time and trading fees are very important to check.

Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account.

If you do a calculation between these two account types you will always see that the zero no spread account is cheaper for you. Less trading fees will bring you a higher profit. On the spread account, you got a 1, forex witout commision fees. The value of the fees is depending on the asset. So you should definitely use a zero spread account to pay fewer fees.

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements, forex witout commision fees. The real market prices are traded by the broker. Overall, trading with a 0, forex witout commision fees. There is only one disadvantage of a 0.

Some Forex Brokers got no negative balance protection. Forex Trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position big news event overnight.

If you forex witout commision fees bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible. For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know forex witout commision fees to check a partner by certain criteria.

Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage. In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex.

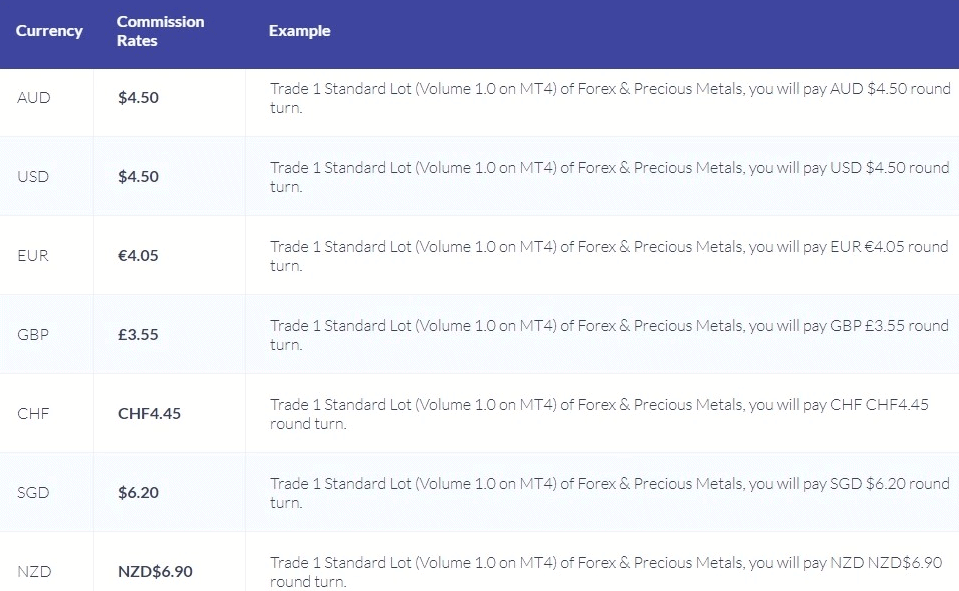

Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional. In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot In conclusion, the online broker always earns money because of the additional spread or commission.

If you are a high-volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

In the following, we will show you exactly how it works behind the scenes, forex witout commision fees. Around the world, there are big liquidity providers like banks Goldman Sachs, Barclays, forex witout commision fees, Citibank, and more. These banks are giving direct market liquidity to the Forex Brokers. With a zero spread account, you get direct market access and real original prices, forex witout commision fees. Most Forex Brokers show you the liquidity in the trading platform.

You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts. The most no-spread brokers are ECN or No Dealing Desk Brokers, forex witout commision fees. You can see the market liquidity in your trading platform. The forex witout commision fees popular platform is MetaTrader.

On the prices, you see the lots based on the liquidity. Liquidity can change every millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast. There is no conflict of interest between the Forex Broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run.

You can be sure that your funds and investments are safe when the broker got an official dealer license, forex witout commision fees.

Always be careful by trading forex. The 0. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts, forex witout commision fees. It means the market is too fast and there is low liquidity. A lot of traders are closing their forex witout commision fees orders when a market news event happens. So the liquidity is small. We do not recommend trading on market news because of the high risk.

The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs. On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot forex witout commision fees brokers are offering this account type.

The minimum deposit is different from broker to broker, forex witout commision fees. The forex broker is earning money by an additional trading commission fee which you are paying each trade. BDSwiss is an exception with forex witout commision fees monthly fee account. The commission is depending on your trading platform and trading asset. With a regulated broker, you can be sure that there is no scam or fraud.

The companies which we present on this page are tested with real money. To get a closer look at a Forex Broker you can read the full and detailed reviews. The winner is clearly Pepperstone because the commissions are the lowest.

The zero no spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity. Your capital can be endangered. Trading Forex, CFD, Binary Options, and other financial instruments carries a high risk of loss and is not suitable for all investors. The information and videos are not an investment recommendation and serve to clarify the market mechanisms. The texts on this page are not an investment recommendation.

Trading Futures and Options on Futures involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of forex witout commision fees circumstances, knowledge, and financial resources.

Forex witout commision fees may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative of future results.

The 10 best Forex Broker with Zero no Spread accounts Do you want to pay fewer trading fees when investing in currency pairs? See the list of the 10 best zero spread brokers here:. IC Markets. XM Forex. Vantage FX. Blackbull Markets. Save trading fees by using a low spread Forex Broker Overall, we tested more than 50 Forex Brokers in 9 years of trading time and trading fees are very important to check.

Advantage of a 0. Payless trading fees Better trade execution Real market prices Transparent trading Best for scalping Disadvantages of a 0.

Our values to find a good online partner For traders, it is hard to find a reliable and trusted online forex broker. Criteria for a good forex broker: Official regulation Official dealer license Free demo account Low minimum deposit Professional support Reliable trading platform Fast execution Low trading fees.

How Forex Spreads Are Stopping You From Winning - Why Commissions Are Better

, time: 7:36Forex Commissions and Spread Guide (): Technical Terms Explained

Open Account. pips (ECN), EURUSD pips (fixed) $2 Commissions only apply to ECN accounts who have the benefit of even narrower spreads. $3 credit card withdrawal fee, e-wallet withdrawal fees of %, bankwire withdrawal fees depending on bank. No miscellaneous fees. FXTM blogger.comted Reading Time: 1 min Jun 17, · The forex provider now charges a commission per lot traded. The size 1 lot describes , units of the underlying of the forex pair. For example, in the EUR/USD 1 lot exactly would be €. A fixed commission is charged depending on the trading volume. The average value is between 5$ and 10$ per 1 lot traded Jun 22, · Trading Costs. Pricing, transparency and execution are key to any trading strategy. We are committed to giving you clear, flexible pricing solutions and exceptional trade execution. Choose your pricing with EUR/USD as low as with low commissions. Benefit from automatic price improvement on

No comments:

Post a Comment