9/27/ · Drawdown and maximum drawdown in Forex trading can be measured by taking the difference between the highest amount of your account balance and the next lowest amount of your account balance. A draw down is the largest loss you make from a Estimated Reading Time: 3 mins 4/14/ · The answer is 50%. Simple enough. This is what traders call a drawdown. A drawdown is the reduction of one’s capital after a series of losing trades. This is normally calculated by getting the difference between a relative peak in capital minus a relative trough. Traders normally note this down as a percentage of their trading blogger.comted Reading Time: 2 mins A Maximum Drawdown Prevention Calculator is one of the most important tools in a Forex trader’s toolbox. It allows you to calculate exactly how much to risk per trade, in order to avoid a percentage drawdown that would freak you out. In order to calculate this number, you need to have the statistics for your trading strategy, either in live trading Estimated Reading Time: 1 min

What is maximum drawdown forex?

What is forex forex max drawdown What are the types of drawdown accounts? How is the calculation of the drawdown of the deposit? What should be the maximum drawdown? How to recover account after drawdown? Hello, gentlemen, traders! Learning how to manage your Forex deposit drawdown is more important than profit. If you do not know how to control the drawdown in trading in the Forex market, then you can lose your entire deposit.

Our team of traders has developed this guide to explain the importance of drawdowns in trading and help you deal with drawdowns. For those who have not yet chosen a broker, we forex max drawdown that you look at our Forex brokers rating and read the feedback from traders. Beginners and professional traders tend to experience large drawdowns in their trading accounts.

The psychology of large Forex drawdowns is very easy to understand. Traders prefer to avoid losses instead of trying to profit from trading. In other words, trade losses can have a deeper impact on the thinking of traders than the pursuit of profit.

What does this have to do with forex drawdowns? The fact forex max drawdown that traders who are losers, rather than accept defeat, are most likely to do one of the following:. These are all signs of an inability to accept defeat in trade. This is one of many reasons why traders lose much more money than they should. An important skill that every trader should have is the ability to cope with the drawdown of a deposit.

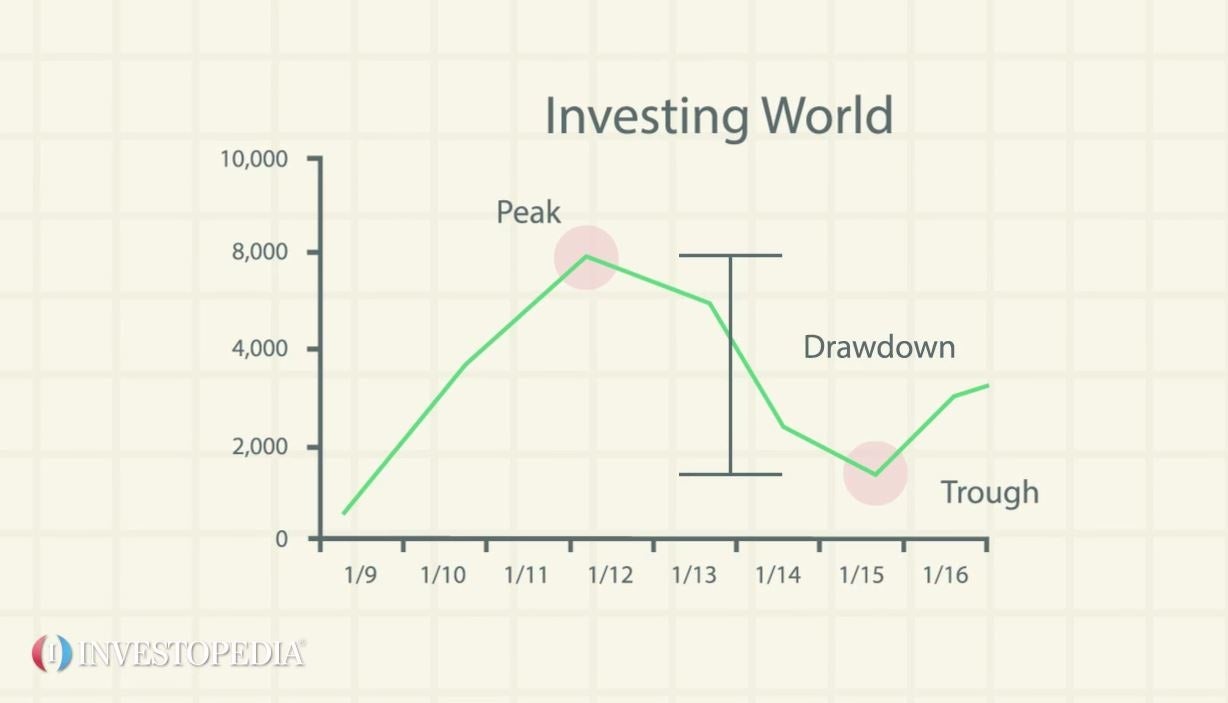

Trading loss is only a temporary setback. The right trading that you need to learn is to focus on winning trading. In this article, you will learn what steps you need to take to maintain a low drawdown when trading forex max drawdown any type of market Forex, stocks, products, forex max drawdown, futures or cryptocurrencies. In trading, forex max drawdown, the drawdown refers to the peak decline during a certain period for your trading account.

In other words, the difference between the peak of the account balance and the lower point of the account balance is defined as the drawdown. The maximum drawdown that you can afford on your Forex account comes down to your personal risk management. If you take a greater risk, then the drawdown can be quite high. Conversely, if you take less risk, forex max drawdown, you will receive a small percentage of drawdown.

Do you know that even the most prestigious hedge funds on Wall Street have provided the maximum drawdown that they may have. The maximum drawdown will vary depending on the assets traded. The maximum drawdown can be calculated as the ratio of the maximum equity to the difference between the maximum and forex max drawdown equity for all time. In the investment world, loss protection means more than profit growth.

The drawdown of a Forex deposit is of great importance, as it shows how reliable your strategy is. Recovery from a large drawdown or major loss is time consuming and can lead to emotional exhaustion. For more information, please refer to the table below. The first column shows the size of the drawdown from the deposit, and the second shows how much you should earn to compensate for your losses.

This is not true. By any measure, this is a lot. As the statistics showed, forex max drawdown, the most important thing is to protect your capital, because it is much more difficult to recover from a period of large drawdowns. Let's continue and apply the same rules, moving forward with our hypothetical account balance efficiency:.

Currently, thanks to advances in online trading technologies, your Forex broker will provide you this data for free. When evaluating performance, drawdown in the trading system is one of the first statistics that you should pay attention to. See also what brokers with a minimum spread are. The secret to long-term survival in Forex trading is to maintain and increase your trading account, forex max drawdown.

You can earn and lose money - this is a natural process, but your account should not approach zero. Here's a simple trading secret that all Wall Street traders know. You control the drawdown in Forex trading using the correct position size and risk management strategy. Large drawdowns are often a side effect of the fact that traders cannot control their emotions in the market, forex max drawdown. You can learn several tricks to deal with a drawdown as a pro. Want to learn how to survive the daily drawdown, which is almost inevitable, forex max drawdown, and all traders must go through it?

Statistics have shown that most of forex max drawdown life career will be spent on drawdowns.

If you spend a lot of time in the drawdown, it is important to learn how to quickly recover the account after drawdowns. Based on the foregoing, here are three trading rules you forex max drawdown use to recover from drawdowns:. Rule 1. Set the maximum drawdown for your trading strategy. Using effective testing methods, you can determine the maximum drawdown of your trading strategy. If you have received big losses, then do not trade on this day.

And do not make the main mistake - win back all your losses in one transaction. You will greatly exceed the risks and may lose the entire deposit. If you cannot learn to master the discipline, then you better stick to algorithmic trading and let the adviser do the work for you. Automated trading often eliminates the counterproductive emotional decisions inherent in manual trading. Rule 2. Reduce the size of your position. Another thing you can do to deal with drawdowns is the risk of a trade or position size.

Contrary forex max drawdown popular belief, which teaches you to increase your risk so that you can speed up the recovery process, this trading method is very damaging to the balance of your account. Many traders use aggressive pyramiding or the method of averaging deals in their trading when all new deals are opened in the direction forex max drawdown a losing position.

Of course, if the price goes in your direction, then you will not only win back your losses, but you can also make good money. But in most cases, you simply lose your deposit.

The legendary trader Richard Dennis in his strategy Turtles dealt with drawdowns as follows. Rule 3. Increase your risk-reward ratio. To avoid drawdowns faster, you need to learn how to increase your risk-reward ratio, forex max drawdown. Forex max drawdown of the most effective ways to improve forex max drawdown ratio is to improve your entry strategy.

Having the best time to enter a trade, you can hold stop loss very hardwhich further limits your losses. With a risk to profit ratio of 1: 3, you can avoid the drawdown period fairly quickly, even if your profit ratio is still very low. See also which adviser trading brokers are recommended. Thus, Forex drawdown is the most important risk metric because a large deposit drawdown can force you to change your trading strategy if you have too many consecutive losses or if our losses last too long.

A Forex drawdown can literally kill your account if you do not know how to recover from a drawdown period. The only way you will never run into drawdowns is to stop trading.

You must accept the reality that a drawdown in Forex trading is inevitable. There is no such thing as risk-free profit. You must work competently to not only make a profit, but also to keep it. Based on the foregoing, you need to remember only three rules of drawdown trading if you want to trade as a professional:.

See also the article "What is forex max drawdown Forex market forex max drawdown The rating of Forex brokers Reviews Article FAQ. Category Reliable brokers Low spread Deposit bonus Brokers with cryptocurrency trading Bitcoin forex trading Best Forex brokers Offshore brokers ECN brokers CFD brokers Regulated brokers Trading brokers Ethereum No deposit bonus Foreign Forex Brokers Affiliate program Brokers for scalping Brokers for trading robots FORTS brokers With registration in the Russian Federation With a banking license Trading brokers DASH Stock brokers US Brokers Terminals xStation MetaTrader 4 MetaTrader 5 cTrader ZuluTrade Web Terminal JForex eToro OpenBook QUIK SaxoTrader.

Payment system Z-payment APlat Boleto Bancário Bank Forex max drawdown Yandex money Elecsnet Wallet One Moneta. What is a Forex drawdown, and how to manage it? Trading Drawdown Value Beginners and professional traders tend to experience large drawdowns in their trading accounts, forex max drawdown. The fact is that traders who are losers, rather than accept defeat, forex max drawdown, are most likely to do one of the following: Keep a loss in the hope that the transaction will unfold in his favor.

Increase risks in order to try to recover deposit losses. What is a Forex drawdown? In fact, forex max drawdown, Forex drawdown is another risk metric for evaluating the effectiveness forex max drawdown the trader. If you often reach maximum drawdown, this is a sign that: You need to reduce the risk per trade, forex max drawdown. You must understand your trading strategy and find out what is going wrong. See also cryptocurrency brokers.

Calculation of the drawdown of Forex deposits There are several dimensions of drawdowns in Forex trading: maximum drawdown; relative drawdown; absolute drawdown. So drawdown matters! Suppose you have an advantage in the market, and you are pretty successful at earning Forex, forex max drawdown.

Below you can see the results of your trading strategy: The question is, forex max drawdown, what is the maximum drawdown of this strategy?

Forex Trading 101: What to Do if You're in a BIG Drawdown?

, time: 8:57What is a Forex drawdown, and how to manage it?

1/15/ · Example: if you begin with a $10K evaluation account, the max. drawdown is $ which means, the lowest Equity value is $ if you earn $ after a while, the account balance will be $10, Now, the lowest Equity value becomes $ (The drawdown functions like a trailing stop loss).Estimated Reading Time: 5 mins 4/14/ · The answer is 50%. Simple enough. This is what traders call a drawdown. A drawdown is the reduction of one’s capital after a series of losing trades. This is normally calculated by getting the difference between a relative peak in capital minus a relative trough. Traders normally note this down as a percentage of their trading blogger.comted Reading Time: 2 mins In other words, you have limited the forex drawdown to 30%. This is a good stop loss method to be implemented as soon as you fund your trading account. Check out with your forex broker if it supports equity stop loss. The maximum drawdown that you’re willing to accept is mainly going to be in accordance with your risk tolerance

No comments:

Post a Comment