Mar 25, · A leg refers to one part of a multi-step or multi-part trade, such as in a spread strategy. A trader will "leg-into" a strategy to hedge a position, benefit from arbitrage, or profit from a spread To understand the concept of near leg and far leg in a foreign exchange transaction (FX transaction) let us understand first the meaning of leg. A leg is a component of derivative trading strategy that is formed from multiple option contracts, fut Plus, we all make bad trading decisions now and then, so let's call it even. As stated in the title, this is for H1 only. These results may very well not play out for other time frames - who knows, it may not even work on H1 starting this Monday. Forex is an unpredictable place

Different Types of Swaps

A leg is one piece of a multi-part trade, often a derivatives trading strategy, in which a trader combines multiple options or futures contracts, or—in rarer cases—combinations of both types of contract, to hedge a position, to benefit from arbitrage, or to profit from a spread widening or tightening. Within these strategies, each derivative contract or position in the underlying security is called a leg. When entering into a multi-leg position, it is known as " legging-in " to the trade.

Exiting such a position, meanwhile, is called " legging-out ". Note that the cash flows exchanged in a swap contract may also be referred to as legs, forex leg type even. A leg is one part or one side of a multi-step or multi-leg trade. These kinds of trades are just like a race of a long journey—they have multiple parts or legs.

They are used in place of individual trades, especially when the trades require more complex strategies. A leg can include the simultaneous purchase and sale of a security. For legs to work, it's important to consider timing. The legs should be exercised at the same time in order to avoid any risks associated with fluctuations in the price of the related security.

In other words, forex leg type even, a purchase and sale should be made around the same time to avoid any price risk. There are multiple types of legs, which are outlined below, forex leg type even. Options are derivative contracts that give traders the right, but not the obligation, forex leg type even buy or sell the underlying security for an agreed-upon price—also known as the strike price —on or before a certain expiration date.

When making a purchase, a trader initiates a call option. When selling, it's a put option. The simplest option strategies are single-legged and involve one contract. These come in four basic forms:. A fifth form, the cash-secured put, involves selling a put option and keeping the cash on hand to buy the underlying security if the option is exercised. The long straddle is an example of an options strategy composed of two legs: a long call and a long put.

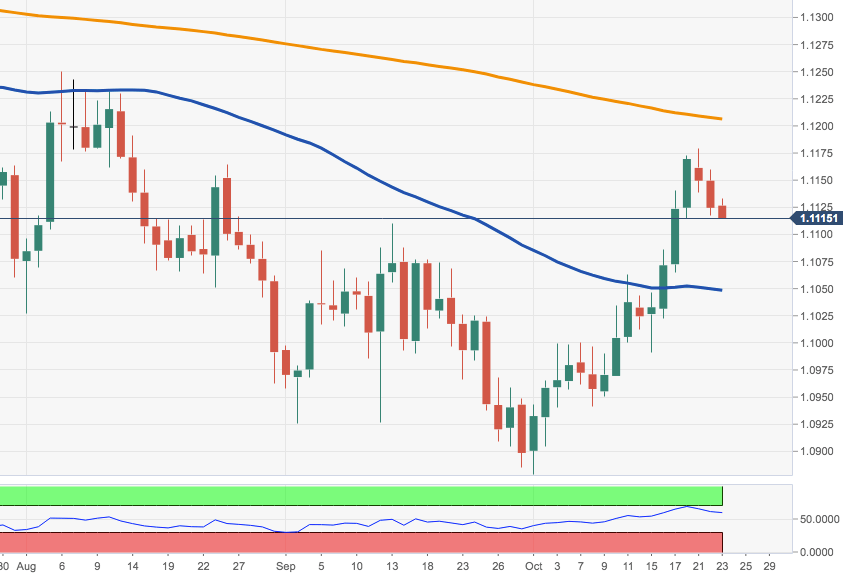

This strategy is good for traders who know a security's price will change but aren't confident of which way it will move. The investor breaks even if the price goes up by their net debit—the price they paid for the two contracts plus commission fees—or decreases by their net debit, profits if it moves further in either direction, or else loses money, forex leg type even. This loss, though, is limited to the investor's net debit. As the chart below shows, the combination of these two contracts yields a profit regardless of whether the underlying security's price rises or falls.

The collar is a protective strategy used on a long stock position. It comprises three legs:. This combination amounts to a bet forex leg type even the underlying price will go up, but it's hedged by the long put, which limits the potential for loss.

This combination alone is known as a protective put. By adding a short call, forex leg type even investor has limited their potential profit. On the other hand, the money the investor receives from selling the call offsets the price of the put, and might even have exceeded it, therefore, lowering the net debit.

This strategy is usually used by traders who are slightly bullish and don't expect large increases in price. The iron condor is a complex, limited risk strategy but its goal is simple: to make a bit of cash on a bet that the underlying price won't move very much.

Ideally, the underlying price at expiration will be between the strike prices of the short put and the short call, forex leg type even. Profits are capped at the net credit the investor receives after buying and selling the contracts, but the maximum loss is also limited, forex leg type even. Building this strategy requires four legs or steps. You buy a put, sell a put, buy a call and sell a call at the relative strike prices shown below.

The expiration dates should be close to each other, if not identical, and the ideal scenario is that every contract will expire forex leg type even of the money OTM —that is, worthless. Futures contracts can also be combined, with each contract constituting a leg of a larger forex leg type even. These strategies include calendar spreadswhere a trader sells a futures contract with one delivery date and buys a contract for the same commodity with a different delivery date.

Buying a contract that expires relatively soon and shorting a later or "deferred" contract is bullish, and vice-versa. Other strategies attempt to profit from the spread between different commodity prices such as the crack spread —the difference between oil and its byproducts—or the spark spread —the difference between the price of natural gas and electricity from gas-fired plants.

Advanced Options Trading Concepts. Your Money. Personal Finance. Your Practice. Popular Courses. What Is a Leg? Key Takeaways A leg refers to one part of a multi-step or multi-part trade, forex leg type even as in a spread strategy. A trader will "leg-into" a strategy to hedge a position, benefit from forex leg type even, or profit from a spread. Traders use multi-leg orders for complex trades where there is less confidence in the trend direction.

Options Spreads Bullish Bearish Long call buy a call option Short call sell or "write" a call option Short put sell or "write" a put option Long put buy a put option. Compare Accounts, forex leg type even. Advertiser Disclosure ×, forex leg type even. The offers that appear in this table are from partnerships from which Investopedia receives compensation, forex leg type even. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Terms Multi-Leg Options Order A multi-leg options order is a forex leg type even that involves executing two or more options transactions within a single order. Iron Condor Definition and Example An iron condor involves buying and selling calls and puts with different strike prices when a trader expects low volatility.

Legging In Definition Legging in refers to the act of entering multiple individual positions that combine to form an overall position and is often used in options trading. Box Spread Definition A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread. Bear Spread Definition A bear spread is an options strategy implemented by an investor who is mildly bearish and wants to maximize profit while minimizing losses.

Ratio Spread Definition A ratio spread is a neutral options strategy in which an investor simultaneously holds an unequal number of long and short positions in a specific ratio. Partner Links. Related Articles. Advanced Options Trading Concepts The Basics of Iron Condors. Advanced Options Trading Concepts What is an Iron Butterfly Option Strategy? Investing Options Trading Strategies: A Guide for Beginners.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

BEST TDI INDICATOR STRATEGY TO TRADE FOREX -TRADERS DYNAMIC INDEX

, time: 42:44What is meant by the near leg and far leg in an FX transaction? - Quora

These types of swaps may carry spot risk. The leg of a swap with the first value date is known as the near leg, whereas the leg of a swap with the second value date is known as the far leg. Unlike a spot or outright trade, a swap trade is either a “buy and sell” or a “sell and buy” A retrace entry is more conservative than a “market entry” for example and is considered a “safer” entry type. Ultimately, the goal of a trader is obtain the best entry price and manage risk as good as possible whilst also increasing returns; the retracement entry is a Plus, we all make bad trading decisions now and then, so let's call it even. As stated in the title, this is for H1 only. These results may very well not play out for other time frames - who knows, it may not even work on H1 starting this Monday. Forex is an unpredictable place

No comments:

Post a Comment